Wealth Management

Time could be on your side when it comes to investing.

Wealth Management

Generally speaking, the longer you invest the more potential your money has to grow. If you are still trying to recover from losses in recent years and you’re looking to get back on track to accumulating wealth, you may want to consider a more aggressive asset allocation with at least a portion of your money. However, those who’ve lost in the stock market may sometimes be a little more wary of approaches that increase their market risks.

If that sounds like you, there are more conservative investment options available that provide the potential for wealth accumulation. Using these investment options in conjunction with insurance contracts such as annuities can help you design a more conservative retirement strategy. After all, the last thing you want to do in retirement is lose more ground during another market correction.

Investments

You worked hard for your assets. Now they can work for you.

Inflation, unexpected expenses, once-in-a-lifetime travel opportunities… Predicting the unpredictable is impossible. That’s why it may be prudent to have a certain amount of your nest egg in investment products.

Investing involves risk, and there are no ways to guarantee that you won’t lose money, but having a certain portion of your assets in the market gives you the opportunity to build on your existing wealth. Over time, that growth potential could help you offset the effects of inflation and other factors that erode the purchasing power of your assets — assets you may be counting on to see you to and through retirement.

From stocks and bonds to mutual funds and retirement accounts, we welcome the opportunity to help you figure out where investment products might fit in your overall financial strategy.

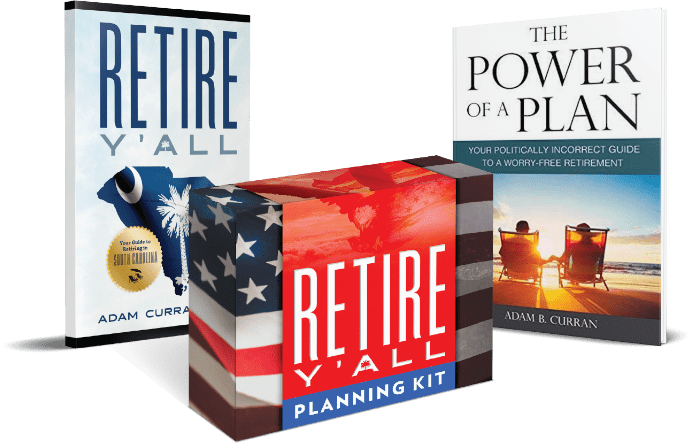

Get your Retire Y’all Planning Kit today!

Fill out your information below to receive Your Retire Y’all Planning Kit

and we will get in touch with you to send you a complimentary copy!