IRA & 401(k) Rollovers

What’s the best way to handle old IRAs and 401(k)s?

When you change jobs or retire, there are four things you can generally do with the assets in any employer-sponsored retirement plan:

- Leave the money where it is

- Take the cash (and pay income taxes and perhaps a 10 percent additional federal tax if you are younger than age 59½)

- Transfer the money to another employer plan (if the new plan allows)

- Roll the money over into an IRA

Rolling over from one qualified plan to another qualified plan allows your money to continue growing tax-deferred until you receive distributions in retirement. We can help you determine if a rollover is the right move for you.

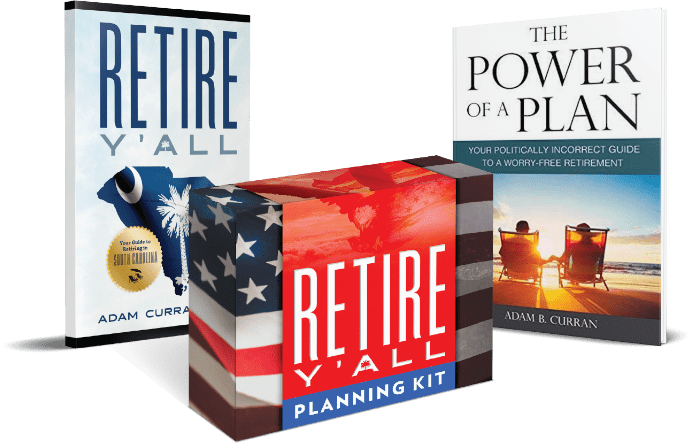

Get your Retire Y’all Planning Kit today!

Fill out your information below to receive Your Retire Y’all Planning Kit

and we will get in touch with you to send you a complimentary copy!